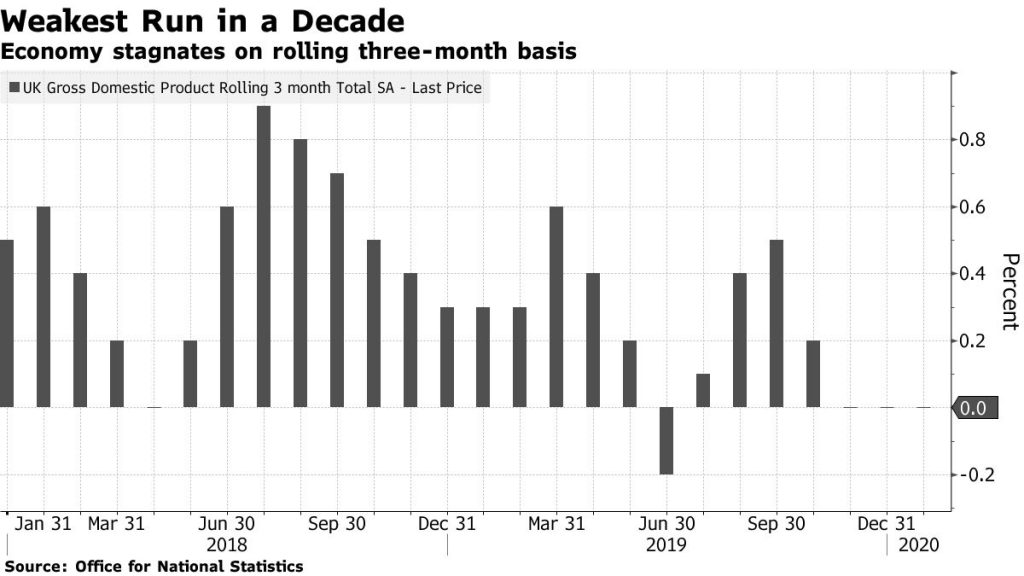

As Rishi Sunak prepares his first budget today, an ‘unexpected’ stalling was reported in British economic growth in January.

In point of fact the accompanying data show a slowdown since the autumn of 2019. But the notion of a setback has only been generally reported this week – and almost exclusively as a consequence of the corona virus epidemic.

So, while he and his Cabinet colleagues bask in their government’s political summer, Sunak faces one of the worst economic situations I can remember. Three – or maybe three-and-a-half – major factors are converging to bring Britain down over the next year or so. The emerging pandemic is only the latest of them.

Three factors converge to bring Britain down

The first dates back over ten years to the banking crash in 2008, when the authorities relied on ‘quantitative easing’ (QE) – a huge expansion in the money supply – as its main response, while doing little to prevent a repetition of the excesses of hedge funds and financial derivatives which led to the crash, or reduce the accompanying high levels of private indebtedness.

Since QE began in 2009, the economy has never been strong enough to put it in reverse, and it has been clear for many years that when the next downturn came, the monetary authorities would have run out of ammunition to tackle it. Private debt has continued to expand, making the situation even more precarious than it was in August 2007, when the credit crunch initiated the great crisis.

In 2009 Gordon Brown’s government, to its credit, embarked on an unfashionable ‘Keynesian’ policy of fiscal expansion to revive demand. Month on month, economic activity began to recover – but it suddenly stalled again when David Cameron’s Conservative government was elected in May 2010. The new government slammed on the fiscal brakes with the 1930s-style policy of austerity, leading to the last ten years of stagnation.

And so, to the first element of the banking crash and excessive monetary expansion, the half-factor of austerity was added.

Then in 2016 came the EU referendum. General predictions of an economic reverse on leaving the European Union were shouted down by Brexiteers as ‘Project Fear’ – and they continue to be so. But the actual shock of leaving has not been felt yet, as the UK remains in the Single Market and Customs Union until at least the end of 2020. But a foretaste is there in the GDP figures of the last few months.

Already an air of crisis

Nevertheless, there is already an air of crisis as the stock markets crashed on March 9th, 2020 – only two days before Sunak’s budget. The proximate cause is the non-economic fact of the gathering pandemic, reinforced by a collapse in oil prices after Saudi Arabia and Russia failed to agree on cutting output.

And that pandemic is Sunak’s third big reason to worry. And it is all that we are hearing from most of the media about the pending state of the economy: the pandemic alone, the rapid progress of which naturally causes widespread concern on its own account.

Despite the Bank of England’s 0.5 per cent interest rate cut this morning, the authorities are in no position now to cope with any serious economic reverse by their long-preferred means, as a result of QE. The only solution from macro-economic policy is to reverse austerity – and renew the fiscal expansion which stopped dead in its tracks just under ten years ago. Even Johnson and Sunak seem to have understood that.

What does this mean politically for their new government? Ten years of recovery from the financial crisis (much faster in other countries than the UK) have already lasted several years longer than most economic upturns, and a recession is overdue. If it occurs – as seems more than likely now – the conventional expectation would be that the government’s popularity would slide.

But will it? After all, Johnson, Sunak and Dominic Cummings have a ready excuse: the semi-fake news of attributing it all to the virus which came over from China. The Remainers – or Rejoiners – might lose the opportunity next year to demonstrate that their predictions about Brexit were not fear-mongering at all.

The clamour will arise from Brexiteers that this is nonsense. An economic crash may have been predictable well before the end of 2019, and yet when it happens they will say it had nothing at all to do with Brexit, or even austerity: it was entirely due to an Act of God.